lake county real estate taxes paid

Call 877 495-2729 Or pay online by clicking the link below. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021.

Ringen Treasurer-Tax Collector 255 North Forbes St.

. Lake County property owners have multiple options for paying their taxes. To pay property tax by phone call 866 506-8035 with credit card or echeck. Where can I access public records.

Tax payments may be sent to our office at 200 East Center St Madison SD 57042 and MUST be postmarked by April 30 and October 31 respectively. Please note that there is a processing fee associated with using a credit card e-check or debit card. Search all services we offer.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. To pay property tax by phone call 866 506-8035 with credit card or echeck. Levy for collection of taxes must be filed with our office on or before the last Tuesday in December in each year.

Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. Printer-friendly Contact Us Treasurer-Tax Collector Barbara C.

Current Real Estate Tax. Pay By Phone Learn how to pay for your property bill over the phone with a credit card. 847-377-2000 Contact Us Parking and Directions.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. CUSTODIAN OF PUBLIC RECORDS. CUSTODIAN OF PUBLIC RECORDS.

To mail your payment send check or money order made payable to Lake County Auditor to. Skip to Sidebar Nav. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone.

This fee is paid to our vendor for the processing. View or pay property tax online. 6686076 email addresses are public.

Paying Your Taxes. A convenience fee will be charged by Lake County for each tax receipt paid with a credit card in accordance with Montana Codes Annotated 7-6-617. Please bring your tax notices with you.

6686076 email addresses are public. When using this option please ensure your line of credit covers the tax payment amount as well as the additional fee. Pay Online Please allow three 3 business days to post.

Main Street Crown Point IN 46307 Phone. Rm 215 Lakeport CA 95453 Tax Collector. Real Estate Tax Rates and Special Assessments.

Vendor payments checks paid 440 350-2814 email protected Agricultural Department. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone. Contact Us Treasurer Physical Address 18 N County Street Room 102 Waukegan IL 60085 Phone.

Sidebar Menu Skip to Page Content. Tax payments must be made for the exact amount only. If the estimated tax due is more than 10000 taxpayers may choose to pay their real estate taxes or tangible personal property taxes on an installment plan.

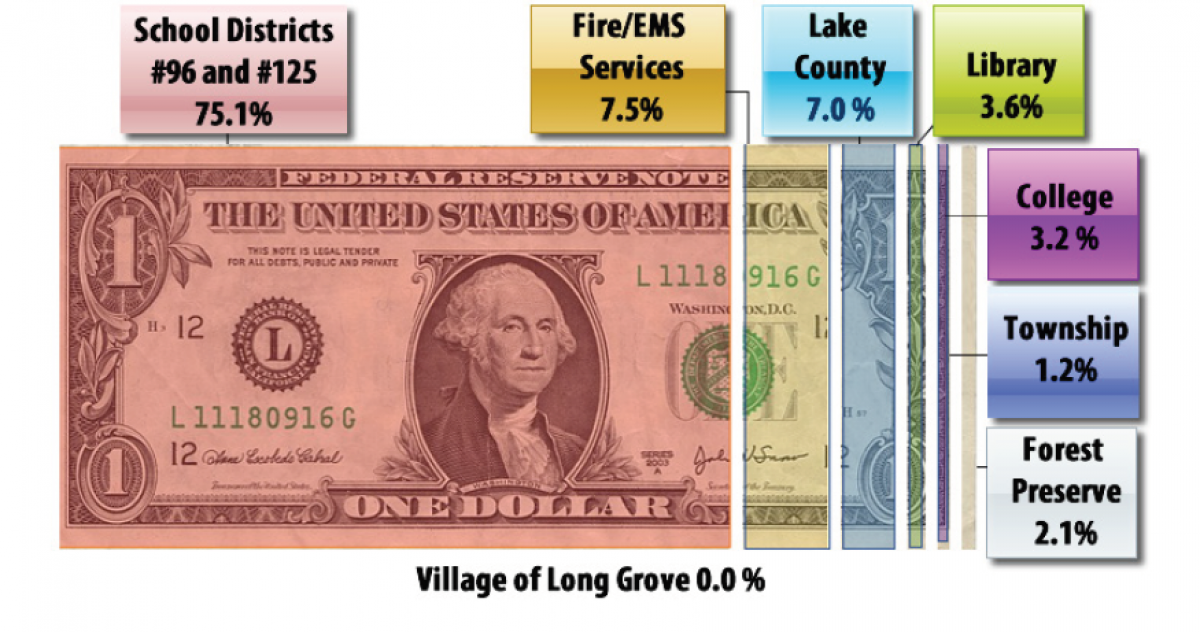

Payments that are mailed must have a. Pay your County Taxes online. School districts get the.

105 Main Street Painesville OH 44077 1-800-899-5253. 105 Main Street Painesville OH 44077 1-800-899-5253. This fee will be charged anytime a.

Online by phone by mail using the drop box located outside the Law Enforcement Center or in person. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS.

Building A 2nd Floor 2293 N. The 2021 Real Property Tax Bills are available online at httpswwwLakeMTgov You may view print and pay your tax bill online. Absolutely no additional funds are provided to any taxing district from these transactions.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. Online E-Check you can use this option by changing the drop down from creditdebit to electronic check under payment method. Payments for property taxes may be made in person using the drop box located outside of the Law Enforcement Center through the mail or online.

Current Secured and Current Unsecured only. Pre-Payments Payments are accepted for the next year. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

The assessors offices are working in the 2021. Lake County Real. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

18 N County Street. 105 Main Street Painesville OH 44077 1-800-899-5253. CAUV Agricultural Districts and Forestry.

105 Main Street Painesville OH 44077 1-800-899-5253. Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. Real Estate taxes can be paid online E-Check only 150 flat rate fee applies if under 10000 you can use this option by changing the drop down from creditdebit to electronic check under payment method.

These fees are not retained by Lake County and therefore are not refundable. Home Departments Auditor Real Estate Tax Rates and Special Assessments. First half property taxes are due April 30 second half are due October 31.

Please note there is a nomimal convenience fee charged for these services. Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS. Maps Records Transparency.

SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 11 2022. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Skip to Page Content Auditor.

Delinquent Taxes Prior Years Sold. Renew Vehicle Registration Search and Pay Property Tax Pay Tourist Tax Run a Real Estate report Run a Tangible Property report. Ad Find Out the Market Value of Any Property and Past Sale Prices.

As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks. As a courtesy to Lake County taxpayers partial payments will be accepted for the current year taxes. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

395 flat fee Visa only To pay click here. The collection begins on November 1st for the current tax year of January through December. Tax rates real estate tax distribution settlement.

Current Secured and Current Unsecured only. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

What Is Florida County Real Estate Tax Property Tax

Lake County Fl Property Tax Getjerry Com

Understanding Your Property Tax Statement Cass County Nd

What Is The Right Tax Proration Amount In Chicago Closings Chicago Real Estate Closing Blog

Property Taxes Lake County Tax Collector

Property Taxes Lake County Tax Collector

Lake County Appeal Home Facebook

The New Age In Indiana Property Tax Assessment

Property Tax Search Taxsys Lake County Tax Collector

Florida Property Tax H R Block

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Property Taxes Lake County Tax Collector

The New Age In Indiana Property Tax Assessment

Taxes Fees Long Grove Illinois

Lake County Property Tax Getjerry Com